- 30 April 2025

Türkiye’s Real Estate Sales Analysis in March 2025

Türkiye’s Real Estate Sales Analysis in March 2025

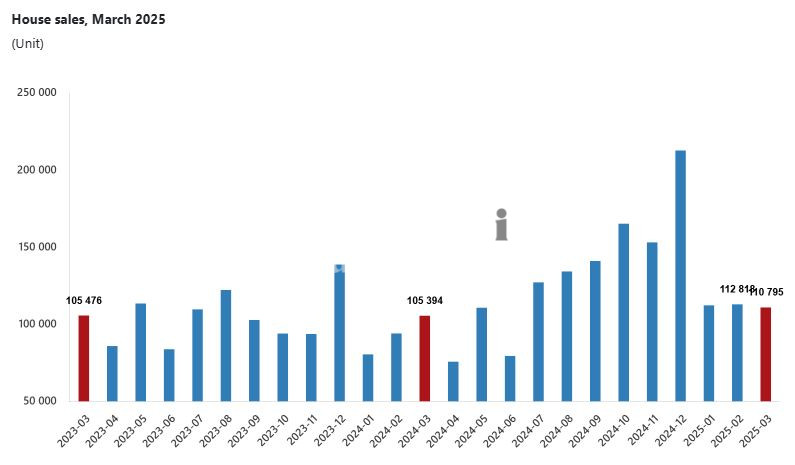

Türkiye’s Real Estate made a noticeable leap in March 2025, signaling both a rebound and a structural evolution in buyer behavior and financing choices. According to recent data from the Turkish Statistical Institute, a total of 110,795 homes were sold, marking a 5.1% increase compared to March 2024. This growth was even more impressive when evaluated over the first quarter, where sales reached 335,786 units, reflecting a 20.1% increase year-over-year.

This article offers an in-depth analysis of these statistics, highlighting the various factors at play in Türkiye’s evolving real estate landscape—including mortgage financing, regional preferences, and foreign investment trends. Let’s explore what’s driving these numbers.

Top Performing Provinces

Real estate activity across Türkiye remains heavily concentrated in metropolitan regions. Not only do these cities provide economic opportunities, but their infrastructures, employment possibilities, and lifestyle amenities continue to attract both local and international buyers.

Highest number of house sales in March 2025:

-

İstanbul – 19,820 houses sold

As the financial and cultural capital of Türkiye, İstanbul remains the top location for real estate transactions. Its wide range of residential offerings—from luxury developments to affordable suburban units—makes it the most active hub in the country. The city’s ongoing mega-infrastructure projects and metro expansions likely contributed to sustained demand. -

Ankara – 10,203 houses sold

Türkiye’s capital city remains a strong player in the housing sector due to its administrative importance and steady middle-class population. New construction in suburban areas such as Etimesgut and Keçiören has expanded housing availability. -

İzmir – 7,513 houses sold

The coastal city of İzmir continues to attract buyers for its relaxed lifestyle and modern developments. The growth in sales suggests a steady demand from both retirees and young professionals seeking to settle in the Aegean region.

Lowest number of house sales in March 2025:

-

Ardahan – 28 houses sold

Situated near the northeastern border, Ardahan’s low numbers reflect the smaller population and limited urban expansion. -

Bayburt – 33 houses sold

Another low-activity region with a relatively static economy and demographic, resulting in fewer housing transactions. -

Tunceli – 63 houses sold

Tunceli, despite some interest in recent years for eco-tourism, still records low property movement likely due to geographic constraints and limited market demand.

These contrasting figures highlight the urban-rural divide in real estate activity and indicate that while the housing market is growing overall, the benefits are unevenly distributed.

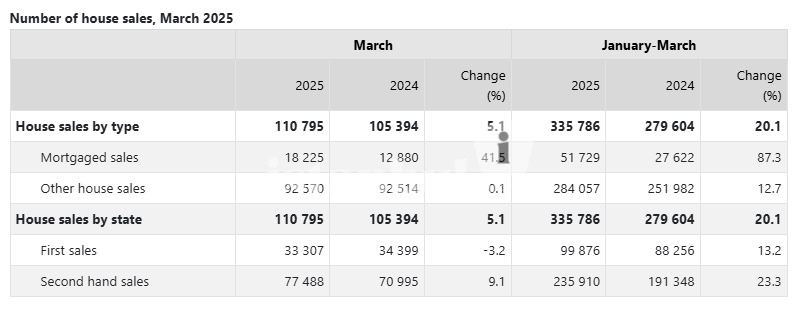

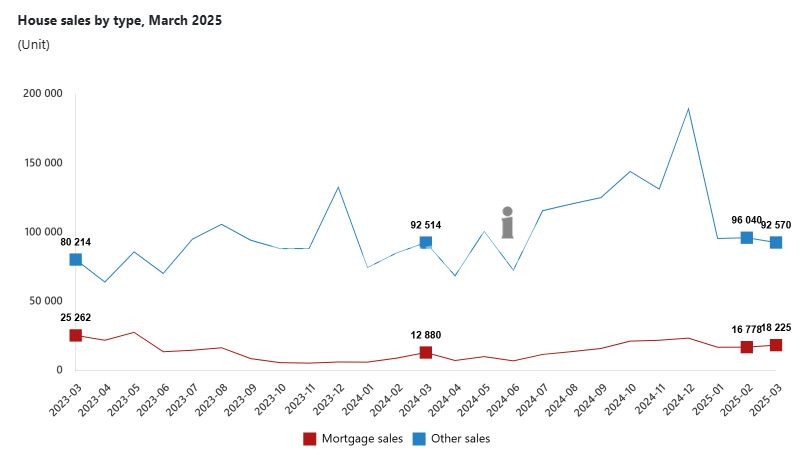

Types of House Sales – Mortgaged vs. Other

The most dramatic change observed in March 2025 was the explosive growth of mortgaged house sales, which increased by 41.5% compared to the previous year. This significant rise may be attributed to more attractive loan conditions, falling interest rates, or increased government incentives to encourage home ownership through financing.

March 2025 Breakdown:

-

Mortgaged sales: 18,225 units

-

Other (non-mortgaged) sales: 92,570 units

Share in total sales:

-

Mortgaged: 16.4%

-

Other: 83.6%

January–March 2025 Performance:

-

Mortgaged sales: 51,729 (↑87.3% from Jan–Mar 2024)

This suggests a nearly doubling of financed purchases, indicating increased buyer confidence and possibly improved access to credit. -

Other sales: 284,057 (↑12.7% from Jan–Mar 2024)

While the increase is moderate, these sales still represent the majority of the market. Many may involve cash buyers or developers offering their own payment plans outside traditional bank loans.

Noteworthy insight:

-

Only 4,331 mortgaged sales in March were first-time sales, with the rest being second-hand purchases. This may reflect how existing homeowners are leveraging mortgage opportunities to upgrade or relocate, rather than new buyers entering the market through loans.

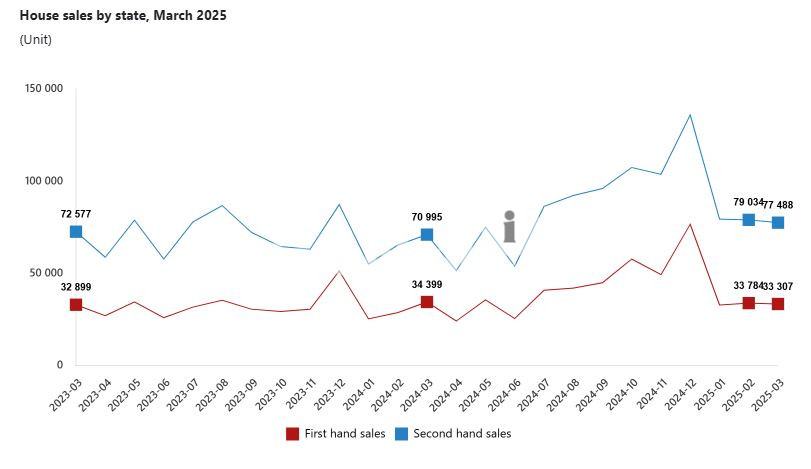

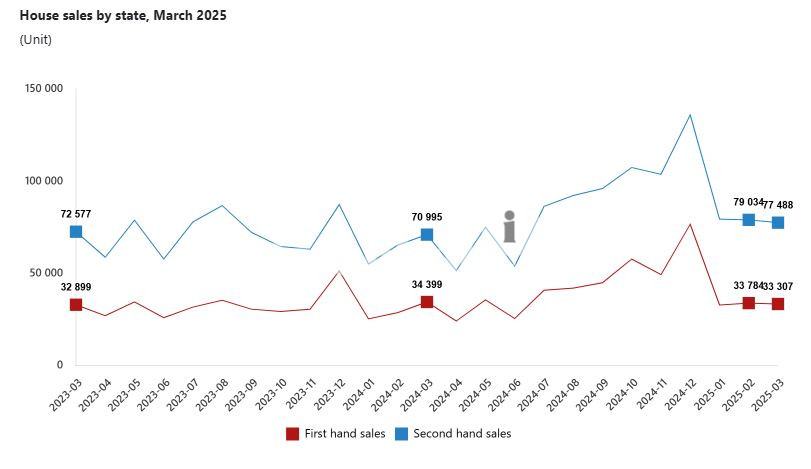

First-Time vs. Second-Hand House Sales

Understanding whether buyers are opting for newly constructed homes or pre-owned ones is crucial for gauging trends in construction, urban development, and pricing flexibility.

March 2025 Trends:

-

First-time house sales: 33,307 units (↓3.2% YoY)

The drop may suggest a cooling in new construction demand, possibly due to rising construction costs, delayed project completions, or buyer preference for established homes. -

Second-hand house sales: 77,488 units (↑9.1% YoY)

A strong gain, signaling that buyers are prioritizing immediate availability, mature neighborhoods, or affordability over new builds.

January–March 2025 Totals:

-

First-time sales: 99,876 (↑13.2%)

-

Second-hand sales: 235,910 (↑23.3%)

Why this matters:

-

Second-hand homes made up nearly 70% of the market, showing that resale properties are driving the housing sector’s recovery.

-

Younger families or investors may prefer second-hand units due to wider location choices or the ability to negotiate better prices.

Foreign Investment in Turkish Real Estate

The foreign segment of the market showed signs of decline, despite Türkiye’s strategic location and relatively affordable housing compared to Western markets.

March 2025 Data:

-

1,574 houses sold to foreigners (↓11.5% from March 2024)

-

Share of total sales: 1.4%

January–March 2025 Total:

-

4,578 houses sold to foreigners (↓19.5%)

Top provinces for foreign buyers:

-

İstanbul – 635 units

A global city and a magnet for diaspora investments, Istanbul remains the top destination despite reduced figures. -

Antalya – 496 units

The Mediterranean lifestyle, climate, and coastal developments keep Antalya high on the list for European and Russian buyers. -

Mersin – 141 units

An emerging market for international investors, particularly Middle Eastern and Central Asian buyers seeking affordable alternatives.

Top nationalities of buyers:

-

🇷🇺 Russia – 275 units

Continuing a multi-year trend, Russian citizens lead the market, likely influenced by geopolitical conditions and a strong ruble-to-lira exchange rate. -

🇮🇷 Iran – 153 units

Iran remains a steady contributor, often purchasing properties for investment or relocation. -

🇺🇦 Ukraine – 124 units

Interest from Ukrainian citizens remains notable, possibly as part of long-term relocation strategies.

Summary Of Sales Report

Total House Sales:

-

110,795 units (↑5.1% YoY)

By Type:

-

Mortgaged: 18,225 units (↑41.5%)

-

Other: 92,570 units (↑0.1%)

By Ownership:

-

First-time: 33,307 units (↓3.2%)

-

Second-hand: 77,488 units (↑9.1%)

Foreign Buyers:

-

1,574 units sold (↓11.5%)

-

Q1 Total: 4,578 units (↓19.5%)

The housing statistics for March 2025 offer clear evidence that domestic demand in Türkiye is rebounding strongly, fueled in part by easier access to mortgages and a growing appetite for second-hand homes. Although first-time home purchases showed a minor decline, the quarterly figures remain encouraging overall.

The foreign market slowdown, on the other hand, is a factor to watch. Regulatory adjustments or more targeted incentives may be required to rekindle international interest.