- 20 May 2024

Analysis Of Turkey’s Housing Market in April 2024

Analysis Of Turkey’s Housing Market in April 2024

Turkey’s unique position bridging Europe and Asia, combined with its growing economy, makes it an attractive investment destination. The government’s focus on infrastructure projects, such as the Istanbul Canal and new airports, enhances the country’s investment for Turkey’s Housing Market.

The Turkish government offers various incentives to attract foreign investors, including citizenship programs for significant real estate investments. This policy enhances the attractiveness of the market for international buyers.

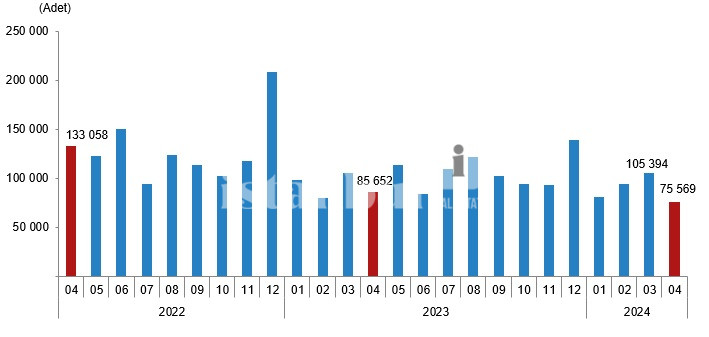

In April 2024, the Turkish housing market exhibited several noteworthy trends, with a mix of declining sales figures and potential investment opportunities. A total of 75,569 houses were sold across the country, reflecting an 11.8% decrease compared to April 2023. This article explores the details of these statistics, regional performances, and the potential for investment in Turkey’s real estate market.

Provincial Breakdown

Istanbul continues to dominate Turkey’s housing market, with 12,406 units sold in April 2024. This metropolis is a magnet for both domestic and international buyers due to its strategic location, vibrant economy, and rich cultural heritage. The demand for real estate in Istanbul remains high despite the overall market downturn, making it a resilient investment location.

Istanbul continues to dominate Turkey’s housing market, with 12,406 units sold in April 2024. This metropolis is a magnet for both domestic and international buyers due to its strategic location, vibrant economy, and rich cultural heritage. The demand for real estate in Istanbul remains high despite the overall market downturn, making it a resilient investment location.

Ankara, the capital city, followed with 6,272 houses sold. Known for its political significance and growing business districts, Ankara offers stable real estate opportunities. Antalya, a popular tourist destination, recorded 4,427 sales, highlighting its appeal not only for vacations but also for permanent residence and investment, particularly among foreigners.

In contrast, the provinces with the least activity were Ardahan with 18 sales, Hakkari with 35, and Tunceli with 49. While these areas may not be prime investment locations, they present opportunities for niche investors looking to diversify their portfolios in emerging markets.

Year-to-Date Sales Performance

- From January to April 2024, housing sales in Turkey reached 355,173 units, representing a 3.7% decrease from the same period in 2023. This decline is part of a broader trend influenced by various economic factors, including interest rates and inflation.

Mortgaged House Sales

Mortgaged house sales experienced a dramatic decline, dropping by 67.5% in April 2024 compared to April 2023, with only 7,071 units sold. The share of mortgaged sales in total housing sales was 9.4%. For the January-April period, mortgaged sales fell by 57.0%, reaching 34,693 units.

Despite this decline, mortgaged properties can still be attractive for investors due to the possibility of negotiating better terms with motivated sellers. Additionally, the drop in mortgaged sales might indicate an upcoming opportunity for price stabilization or even decreases, making it a potentially favorable time to invest.

Other Types of Sales

Sales through methods other than mortgages increased by 7.2% in April 2024 compared to the previous year, totaling 68,498 units. This segment represented 90.6% of all housing transactions. From January to April, other sales rose by 11.2%, reaching 320,480 units. The growth in this segment suggests a robust demand for real estate that is not dependent on financing, indicating confidence in the market and opportunities for cash buyers.

First-Hand vs. Second-Hand Sales

First-hand house sales amounted to 24,085 in April 2024, a 10.6% decrease from April 2023. These new properties constituted 31.9% of total sales. However, in the January-April period, first-hand sales increased by 1.3%, reaching 112,341 units. New developments continue to attract buyers, reflecting ongoing urbanization and development trends.

Second-hand house sales were 51,484 in April 2024, down by 12.3% from April 2023, making up 68.1% of total sales. From January to April, second-hand sales decreased by 5.9%, totaling 242,832 units. Despite the decline, the large volume of transactions indicates a steady demand for existing homes, offering numerous opportunities for investors to find undervalued properties.

Sales to Foreigners

Sales to foreigners saw a significant decline, dropping by 50.3% in April 2024 compared to April 2023, with only 1,272 units sold. These sales constituted 1.7% of total housing transactions. Antalya led this segment with 454 units sold to foreigners, followed by Istanbul with 407, and Mersin with 149.

From January to April, sales to foreigners decreased by 48.4%, totaling 6,957 units. The most active buyers were from the Russian Federation (293 units in April), Iran (117), and Ukraine (91). Despite the decline, Turkey remains a desirable destination for foreign investors due to its cultural appeal, economic potential, and strategic location.

Related Posts

Turkey’s Housing Market Trends In January 2024