- 17 November 2023

Turkey’s Real Estate: October 2023 Housing Market Analysis

Turkey’s Real Estate: October 2023 Housing Market Analysis

Introduction:

The housing market in Turkey’s Real Estate for October 2023, is issued by the Turkish Statistical Institute (TUIK). It reflects the complex interaction of economic, regulatory, and global factors. This detailed report looks into the details, including regional variations, mortgage trends, and the balance between selling new and used homes.

Also the interesting patterns in foreign buyer behavior, providing valuable insights into the ever-evolving landscape of Turkey’s real estate sector. As the market continues to navigate these multifaceted dynamics, Turkey’s real estate remains a dynamic and evolving sector, reflecting the country’s broader economic and global influences.

1. Market Trends and Dynamics:

The housing market in Turkey witnessed a decline in October 2023, with an 8.7 percent reduction in sales compared to the corresponding month in the previous year. The total number of houses sold amounted to 93,761. This decline continued in the January-October period, showing a 14.3% decrease, totaling 993,835 units sold during this time.

The housing market in Turkey witnessed a decline in October 2023, with an 8.7 percent reduction in sales compared to the corresponding month in the previous year. The total number of houses sold amounted to 93,761. This decline continued in the January-October period, showing a 14.3% decrease, totaling 993,835 units sold during this time.

2. Istanbul’s Increasing Influence and Tourism Appeal

Istanbul’s Dominance: In October 2023, Istanbul stood out in housing sales, leading with an impressive 14,941 transactions, making up 15.9 percent of the market. Following closely, Ankara recorded 7,394 house sales, contributing 7.9 percent.

While Izmir secured a notable position with 5,192 sales, constituting a 5.5 percent share. Meanwhile, the provinces with the lowest housing sales were Hakkari, Ardahan, and Bayburt, reporting 40, 43, and 80 sales, respectively.

Moreover, Turkey’s tourism sector is experiencing a rich summer season, with an increase in foreign visitors to Mediterranean resorts and Istanbul. The Vice President of the Turkish Hoteliers Federation, Mehmet Isler, is positive about more growth in the fall, expecting 60 million tourists by 2023. Despite a slow period after earthquakes, Turkey still welcomed 7.15 million foreign visitors, with Istanbul having the most in ten years.

Isler mentioned interest from new markets like the Far East and Latin America, but Germany and Russia are still the top contributors. Reservations are up by 15%, and they’re hopeful the tourist season will stretch into November and December, aiming for a record 3.5 million UK tourists by the end of the year.

3. Mortgaged House Sales: A Deep Dive into Financing Dynamics:

In October, the number of houses bought with mortgages in Turkey went down a lot, by 58.0% compared to the same month last year, reaching 5,577 units. This decrease shows that getting financing for buying houses has become more difficult.

In October, the number of houses bought with mortgages in Turkey went down a lot, by 58.0% compared to the same month last year, reaching 5,577 units. This decrease shows that getting financing for buying houses has become more difficult.

From January to October, mortgaged house sales decreased by 31.2%, adding up to 166,461 units. It’s interesting to note that in October, 1,369 of the houses bought with mortgages were brand-new, indicating a specific trend in that part of the market.

4. New vs. Second-Hand Sales:

- First-Hand Sales: In October, there was a 10.6% drop in the sale of brand-new houses, making up 31.2% of the total sales (29,230 units). From January to October, there was a 13.6% decrease in brand-new house sales, totaling 297,827 units.

- Second-Hand Sales: For second-hand houses, there was an 8.7% decrease in October, making up a big portion of total sales at 68.8% (64,531 units). Over the January-October period, second-hand house sales went down by 14.6%, reaching 696,008 units. Looking at both segments helps us understand what people prefer and the dynamics of the housing market.

5. Foreign Buyer Trends : Turkish Market

Overall Foreign Sales: In October, the number of houses sold to foreigners in Turkey dropped significantly by 52.9%, totaling 2,535 units compared to the same month the previous year. This trend continued from January to October, witnessing a 44.4% decline, with a total of 30,599 units sold.

Overall Foreign Sales: In October, the number of houses sold to foreigners in Turkey dropped significantly by 52.9%, totaling 2,535 units compared to the same month the previous year. This trend continued from January to October, witnessing a 44.4% decline, with a total of 30,599 units sold.- Top Locations for Foreign Buyers: The top locations for foreign buyers were Antalya, leading with 931 units, followed closely by Istanbul with 758 units and Mersin with 294 units. This diverse geographic distribution highlights the broad appeal of Turkish real estate to international investors.

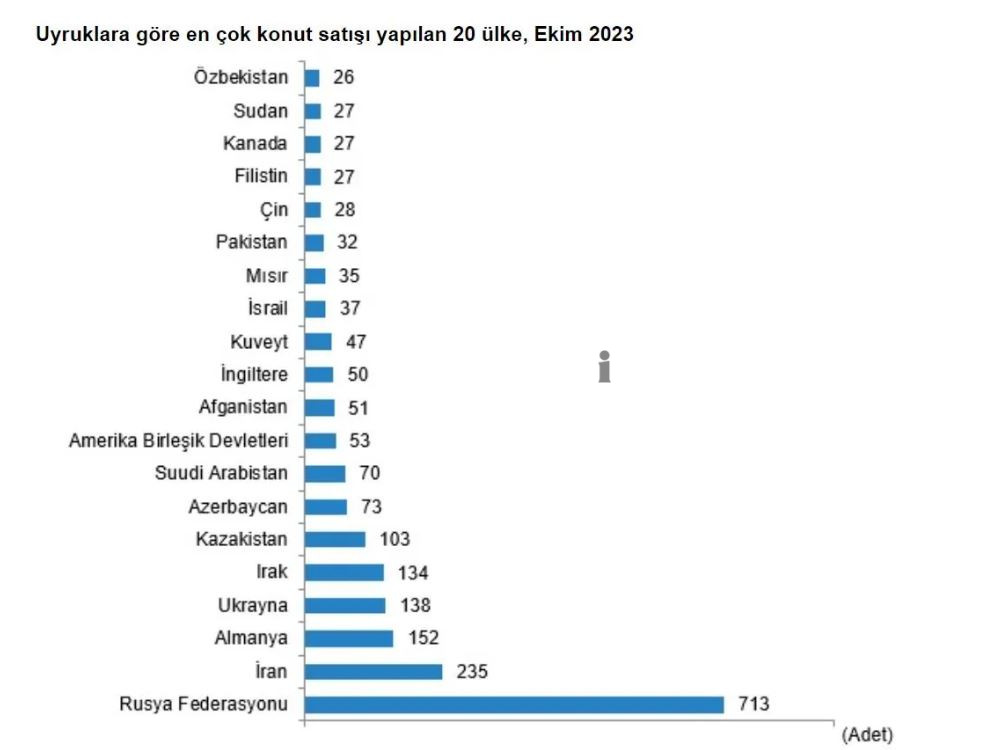

- Buyer Nationalities: Examining the nationalities of foreign buyers, citizens from the Russian Federation secured the top position by purchasing 713 houses. Investors from Iran, Germany, and Ukraine were also interested, showing that buyers from different countries prefer Turkey’s real estate.

6. Market Implications and Future Prospects:

The housing market data for October 2023 shows a complicated situation, indicating a tough period with fewer overall home sales, especially in mortgaged and foreign buyer categories.

The housing industry’s ability to withstand economic changes, along with proactive measures, will be crucial in shaping future market trends. In summary, the October 2023 housing market data gives us many insights into the diverse nature of the Turkish real estate scene.

Related Posts