- 30 December 2023

Investing In Real Estate: A Comparison Between Dubai and Turkey

Investing In Real Estate: A Comparison Between Dubai and Turkey

Deciding where to invest in real estate Dubai or Turkey requires a a good understanding of various factors. From housing prices and additional costs to property ownership expenses and residency options, each aspect plays a role in making the right choice.

In this comparison, we’ll break down these elements, offering clear insights for those seeking a straightforward guide to real estate investment in Dubai and Turkey. Whether it’s the city life in Dubai or the diverse landscapes of Turkey, understanding the details will help you make an informed decision aligned with your preferences and financial objectives

Residency and Citizenship:

Dubai:

Dubai:

In Dubai, you can secure residency by investing at least 750,000 dirhams in property. Opting for a property worth over two million dirhams grants you a 10-year golden visa. However, gaining citizenship is challenging, usually requiring a significant contribution or investment. There’s no fixed investment amount, and dual citizenship is not allowed. Eligibility for Emirati citizenship includes women married to a UAE citizen for three years, children of UAE citizens, and foreigners living legally in the country for 7 to 30 years, depending on their nationality.

Turkey:

Acquiring Turkish citizenship is possible through avenues like purchasing real estate valued at $400,000, maintaining a $500,000 deposit in a bank for three years, or establishing a company employing at least 50 Turkish citizens. Citizenship is more accessible, with fixed investment requirements. Applying through real estate or contributing to the economy is possible. Turkey allows dual citizenship, providing a more straightforward process compared to Dubai.

Turkey, with its rich history and a population of 83.6 million, offers compelling advantages for its citizens. Boasting the second-largest NATO military and the 18th largest global economy, with Turkish passport citizens with visa-free can travel around 115 countries and access to a 10-year multiple entry visa to the United States.

Turkish citizens enjoy free education from Kindergarten to University, comprehensive healthcare covering various medical needs, and assistance in marriage, accommodation, and employment. With a multicultural environment, natural beauty, and a rich cultural heritage, Turkey is an affordable and attractive place to live.

Dubai Residential Market Highlights – October 2023:

In October 2023, Dubai’s residential real estate market saw 7,523 transactions, marking an 8.3% decline YoY. This dip was primarily driven by a 41.5% decrease in off-plan sales, while secondary market sales rose by 30.5%. Year-to-date transactions totaled 87,154, surpassing 2022 figures.

Average prices in Dubai witnessed a robust growth of 19.6%. Apartment prices increased by 19.7% to AED 1,357 per sq ft, and villa prices rose by 18.9% to AED 1,605 per sq ft. Despite a general market decrease from 2014 levels, certain residential areas have outperformed these benchmarks.

Downtown Dubai registered the highest sales rate per sq ft in the apartment segment at AED 2,453, while Palm Jumeirah led in the villa segment with AED 4,995 per sq ft.

In the rental market, a 20.6% increase was observed in the 12 months to October 2023, slightly down from the previous month. In dubai, annual apartment and villa rents reached an average of AED 108,606 and AED 322,750. Moreover, Palm Jumeirah recorded the highest annual apartment rents at AED 257,366, while Al Barari led in villa rents at AED 1,098,788.

Dubai: One of the significant attractions for property investors in Dubai is its tax-friendly environment. Not only does Dubai have no annual property taxes, but it also refrains from taxing rental income. This policy contributes to a more straightforward and cost-effective ownership experience for individuals and businesses alike, making Dubai an appealing destination for real estate investment.

Turkey Residential Property Update – October 2023:

In October 2023, property sales in Turkey totaled 93,761 houses, reflecting an 8.7% decline compared to the same period in the previous year. Istanbul led the sales with a 15.9% share, accounting for 14,941 houses, followed by Ankara and İzmir with 7,394 and 5,192 house sales, respectively. However, the trend of declining property sales persisted in the January-October 2023 period, registering a 14.3% decrease compared to the same timeframe in the previous year, totaling 993,835 houses sold.

Turkey: In Turkey, property owners face an annual property tax, which is calculated based on the cadastral value of the property. The tax rate ranges from 0.1% to 0.3%, providing a relatively low and predictable tax burden. While Turkey offers competitive property prices, potential investors need to consider the ongoing property tax as a factor in their overall cost of ownership.

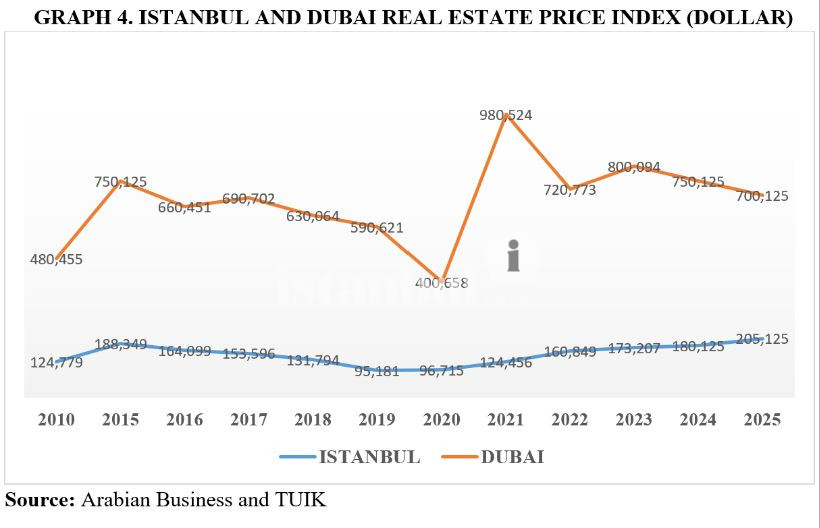

Comparing Residential Prices:

Looking at the graph, it’s clear that Istanbul’s real estate prices stay steady, providing a reliable market. In contrast, Dubai’s residential prices fluctuate more, despite its reputation for fast growth. While Dubai has the benefit of no annual property taxes and offers a luxurious living experience with high-quality construction, its property prices can be unpredictable due to speculative cycles.

Looking at the graph, it’s clear that Istanbul’s real estate prices stay steady, providing a reliable market. In contrast, Dubai’s residential prices fluctuate more, despite its reputation for fast growth. While Dubai has the benefit of no annual property taxes and offers a luxurious living experience with high-quality construction, its property prices can be unpredictable due to speculative cycles.

Dubai’s rapid development comes with ups and downs in property values. On the other hand, Istanbul’s growth is more consistent, driven by economic reforms, a diverse economy, and a strategic location. Unlike Dubai, Istanbul’s growth is based on genuine demand from various sectors like tourism, real estate, manufacturing, and services, making it a more stable market overall.

Rental Yields & Average Property Prices:

- Average Apartment Rent: AED 109,000 annually.

- Average Villa Rent: AED 323,000 annually.

- Highest Apartment Rent: AED 257,000 (Palm Jumeirah).

- Highest Villa Rent: AED 1.1 million (Al Barari).

Dubai’s rental market caters to a diverse range of residents, from those seeking more affordable apartment living to those looking for luxurious villas in prestigious neighborhoods. The variability in rental rates is influenced by factors such as location, amenities, and the overall quality of the property. As Dubai continues to be a global hub, its rental market remains an integral aspect of the city’s real estate landscape.

In Dubai, annual property maintenance costs range from $20 to $100 per square meter. In Turkey, monthly aidat fees vary from $15 to $150, with higher rates in premium complexes. Overall, Turkey tends to have more budget-friendly property maintenance costs.

Turning to rentals, Dubai and Turkey showcase different scenarios. Dubai’s rental prices can be relatively high due to luxury real estate and high demand. In contrast, Turkey offers more affordable rental options, catering to diverse budgets in urban and rural settings. The Turkish rental market is known for its flexibility, making it an appealing choice for those seeking cost-effective housing solutions.

Turning to rentals, Dubai and Turkey showcase different scenarios. Dubai’s rental prices can be relatively high due to luxury real estate and high demand. In contrast, Turkey offers more affordable rental options, catering to diverse budgets in urban and rural settings. The Turkish rental market is known for its flexibility, making it an appealing choice for those seeking cost-effective housing solutions.

In Turkey, housing is more affordable, with Antalya starting at $900 per square meter, and smaller towns and villages ranging from $650 to $700 per square meter. This price difference positions Turkey as a more economical option for those looking for affordable housing compared to Dubai’s higher-end offerings.

Summary:

In summary, the comparison between real estate investment in Dubai and Turkey yields distinct conclusion. Turkey emerges as a more budget-friendly option, offering affordable housing and generally lower property upkeep costs. The process of buying property in Turkey is perceived to be more straightforward, making it potentially more accessible for investors. Dubai, on the other hand, boasts a tax advantage with no annual property taxes and presents a luxurious living experience with high-quality construction. Both locations exhibit promising economic stability and growth potential, while the choice ultimately depends on individual preferences, financial considerations, and long-term goals.

Housing Prices Verdict: Turkey is more affordable.

Other Costs Verdict: Turkey’s process is slightly more straightforward.

Cost of Ownership Verdict: Turkey generally has more affordable upkeep costs.

Taxes Verdict: Dubai holds a tax advantage.

Residency/Citizenship Verdict: Turkey provides a more accessible path.

Quality of Construction: Both offer a comfortable living experience.

- Dubai: Luxurious and modern infrastructure.

- Turkey: Significant improvements, good value for money.

Economic Stability: Both offer relative economic stability.

- Dubai: Economic stability but susceptible to oil market fluctuations.

- Turkey: Resilient economy with steady growth.